The Ethereum mainnet used to be the hub of all on-chain activity. However, with the growth of alternative execution layers (particularly Base and Solana) and many other L1/L2s contending for users, Ethereum's role has arguably diminished, particularly in recent months.

Ethereum is still #1 in TVL by a wide margin. Per DeFiLlama, it is over five times larger by this metric than the second-largest blockchain, Solana, and 53.9% of all stablecoins are on Ethereum. On the other hand, in 30-day DEX volumes, Solana is at $265bn vs. $93bn on Ethereum. Base is at $51bn and consistently increasing its market share.

Most notably, Ethereum is no longer the most fee-generating protocol, ranking 9th with individual applications like Uniswap, Jito, Raydium, and PancakeSwap overtaking it in recent months. This combined with lackadaisical price action has driven a discussion on what exactly Ethereum’s role and the value of ETH, the asset, will be in the future. If transaction execution (i.e. users and usage) moves to other chains (including L2s), how does ETH capture value?

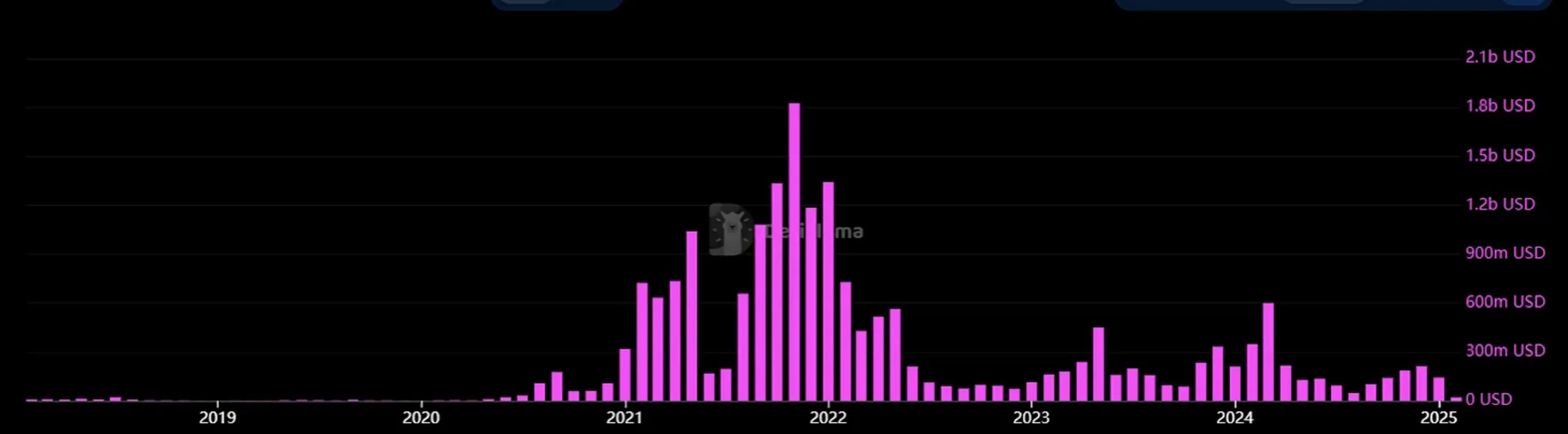

Ethereum, fees generated per month. Source: DefiLlama.

Now, it’s possible to argue (and some do) that Ethereum captures enough value from its “moneyness” and fees from data blobs posted by L2s. The money aspect is a very different argument and outside the scope of this blog post where we are discussing fees and valuing blockchains by some reasonable multiple relative to them.

To take a step back—when Ethereum was launching—it’s worth remembering that the idea of what businesses would look like on blockchains was quite different from today's. The idea was that blockchains and the core functions facilitated by them would be viewed more as Internet protocols than businesses. Money transfer and other related functions are like TCP/IP, but they touch value, not just information.

Vertical (or horizontal) integration across the stack doesn’t make sense in that context. The exchange protocol will handle asset exchange, the oracle protocol will bring in outside information, and the lending protocol will be used for – well, lending. Protocols doing other things apart from their core function violate the “credible neutrality” of an Internet protocol.

X Post by Hayden Adams, founder of Uniswap.

Messy real-world incentives burst this pretty picture. In practice, most major DeFi protocols will extend out to multiple functions – lenders become stablecoin providers (e.g. Aave), liquid staking gets mixed in with the MEV supply chain (e.g. Jito), and bridge providers become exchanges. It’s not far-fetched to imagine a single protocol with one token that is an execution layer, a data-availability provider, an exchange (spot and derivatives), a liquid staking service, and a lending/stablecoin platform. This was (to a degree) the vision behind the Canto blockchain.

Crypto is just like any other business. The incentive to go after new markets to create more value for tokenholders is clear. And with other businesses encroaching – either purposefully or not, this is also by design if you build a chain with L2s in mind – on Ethereum’s “territory”, a natural response is to push back.

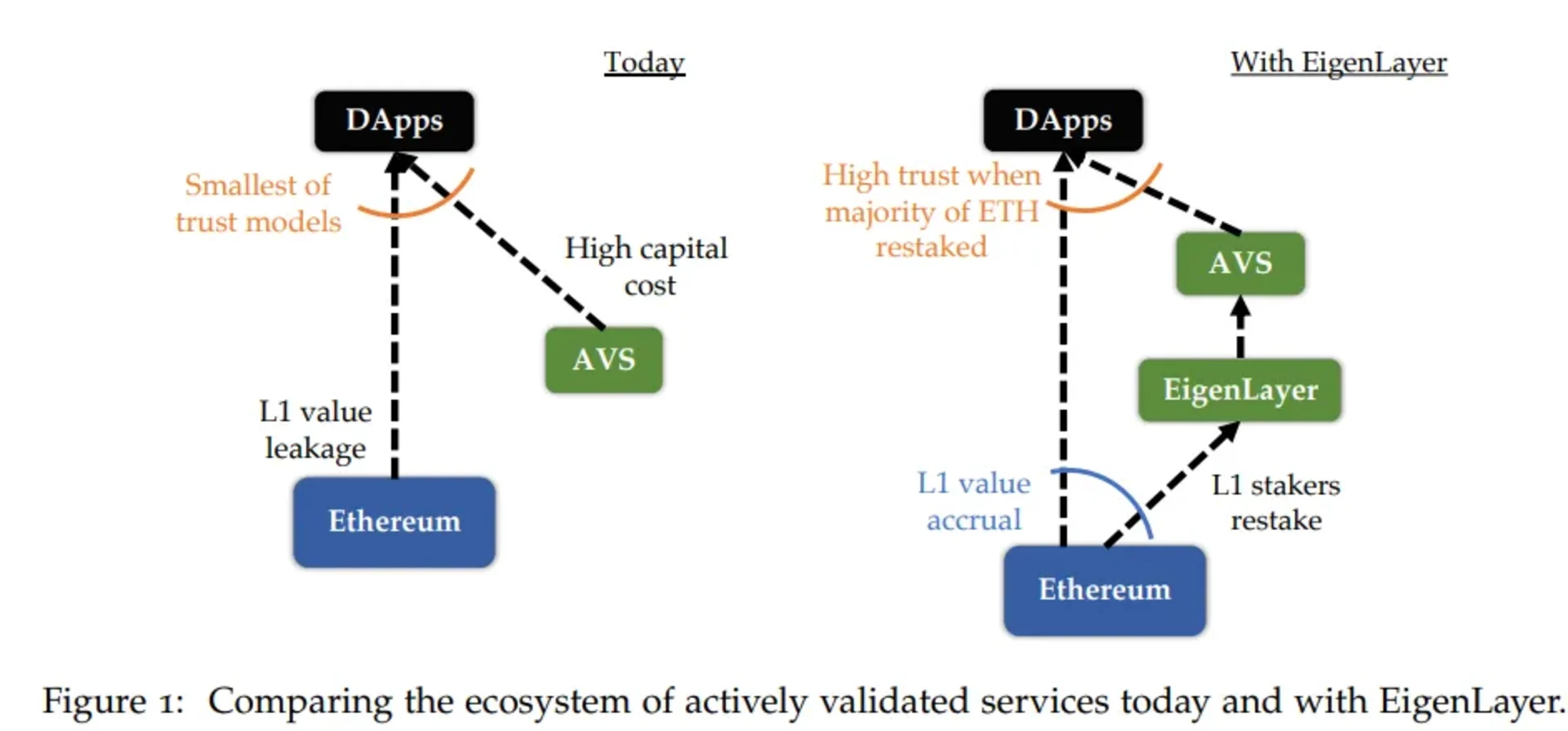

Illustration from the EigenLayer whitepaper.

EigenLayer, and the subsequent growth in attention and funding for other restaking projects, is arguably a type of response by the market to extend out Ethereum’s features and drive more value to ETH. Instead of “requiring” a new token to secure an oracle, L2, or token bridge, all you need is ETH. One can make fanciful arguments around economic security that make for long whitepapers (more common in 2017 than today) but expanding the functionalities of ETH is the core argument for restaking systems.

2 weeks ago, Justin Drake published a proposal on “Native Rollups”. In short, this enables direct L1 execution integration. Instead of running a separate virtual machine (VM) or relying solely on off-chain computation, native rollups would leverage the L1’s native execution engine. A new precompile to verify EVM state transitions for batches of user transactions. Soon, you’ll also see “Based Rollups” coming to market where MEV naturally flows to L1 validators. There’s a longer discussion to be had about what features and limitations this locks in and what the economics are for L2s, but in short, these ideas drive more transaction and MEV fees to ETH holders.

Here’s a prediction: in the next 6 months, there will be a high-profile fundraise for an “ETH Maxi L2”. This L2 will fork the major (mostly ossified) protocols in DeFi and turn on all fee switches, driving both application and sequencer revenue to ETH holders. The promise is that there will not be a native token and a portion of the fees generated go to the founding team for development and as incentives. As the technology for building L2s matures, go-to-market is more important than technical differences that are becoming ever-less distinctive. “ETH Maxi L2” is a potentially viable go-to-market strategy.

Native and Based Rollups, restaking, and the reinvigorated enthusiasm to increase gas limits to increase execution capacity are all examples of the Ethereum community (and ETH holders) “fighting back” and increasing Ethereum’s role in transaction activity. On the other hand, rollups that drive value to ETH holders are also in direct competition with those that don’t – and that’s not entirely “credible neutral” activity.

Continue reading

May 28, 2025

State of Verifiable Inference & Future Directions

Verifiable inference enables proving the correct model and weights were used, and that inputs/outputs were not tampered with. This post covers different approaches to achieve verifiable inference, teams working on this problem, and future directions.

March 25, 2025

Introducing Our Entrepreneur in Residence (EIR) Program

After 6+ years of building core blockchain infrastructure across most ecosystems and incubating ventures like ZkCloud, we're looking for ambitious pre-founders with whom to collaborate closely.

March 10, 2025

From Speculation to Utility: Next Steps For Onchain Lending Markets

Despite its promises, onchain lending still mostly caters to crypto-natives and provides little utility besides speculation. This post explores a path to gradually move to more productive use cases, low-hanging fruit, and challenges we might face.

February 18, 2025

Can Blockchains And Cryptography Solve The Authenticity Challenge?

As gen-AI models improve, it's becoming increasingly difficult to differentiate between AI- and human-generated content. This piece dives into whether cryptography and blockchains can solve the authenticity challenge and help restore trust on the Internet

January 29, 2025

Equilibrium: Building and Funding Core Infrastructure For The Decentralized Web

Combining Labs (our R&D studio) and Ventures (our early-stage venture fund) under one unified brand, Equilibrium, enables us to provide more comprehensive support to early-stage builders and double down on our core mission of building the decentralized web

November 28, 2024

20 Predictions For 2025

For the first time, we are publishing our annual predictions for what will happen by the end of next year and where the industry is headed. Joint work between the two arms of Equilibrium - Labs and Ventures.

November 7, 2024

9 + 1 Open Problems In The Privacy Space

In the third (and final) part of our privacy series, we explore nine open engineering problems in the blockchain privacy space in addition to touching on the social/regulatory challenges.

October 15, 2024

Aleo Mainnet Launch: Reflecting On The Journey So Far, Our Contributions And Path Ahead

Equilibrium started working with Aleo back in 2020 when ZKPs were still mostly a theoretical concept and programmable privacy in blockchains was in its infancy. Following Aleo's mainnet launch, we reflect on our journey and highlight key contributions.

August 12, 2024

Do All Roads Lead To MPC? Exploring The End-Game For Privacy Infrastructure

This post argues that the end-game for privacy infra falls back to the trust assumptions of MPC, if we want to avoid single points of failure. We explore the maturity of MPC & its trust assumptions, highlight alternative approaches, and compare tradeoffs.

June 12, 2024

What Do We Actually Mean When We Talk About Privacy In Blockchain Networks (And Why Is It Hard To Achieve)?

An attempt to define what we mean by privacy, exploring how and why privacy in blockchain networks differs from web2, and why it's more difficult to achieve. We also provide a framework to evaluate different approaches for achieveing privacy in blockchain.

April 9, 2024

Will ZK Eat The Modular Stack?

Modularity enables faster experimentation along the tradeoff-frontier, wheras ZK provides stronger guarantees. While both of these are interesting to study on their own, this post explores the cross-over between the two.

October 5, 2023

Overview of Privacy Blockchains & Deep Dive Of Aleo

Programmable privacy in blockchains is an emergent theme. This post covers what privacy in blockchains entail, why most blockchains today are still transparent and more. We also provide a deepdive into Aleo - one of the pioneers of programmable privacy!

March 12, 2023

2022 Year In Review

If you’re reading this, you already know that 2022 was a tumultuous year for the blockchain industry, and we see little value in rehashing it. But you probably also agree with us that despite many challenges, there’s been a tremendous amount of progress.

May 31, 2022

Testing the Zcash Network

In early March of 2021, a small team from Equilibrium Labs applied for a grant to build a network test suite for Zcash nodes we named Ziggurat.

June 30, 2021

Connecting Rust and IPFS

A Rust implementation of the InterPlanetary FileSystem for high performance or resource constrained environments. Includes a blockstore, a libp2p integration which includes DHT contentdiscovery and pubsub support, and HTTP API bindings.

June 13, 2021

Rebranding Equilibrium

A look back at how we put together the Equilibrium 2.0 brand over four months in 2021 and found ourselves in brutalist digital zen gardens.

January 20, 2021

2021 Year In Review

It's been quite a year in the blockchain sphere. It's also been quite a year for Equilibrium and I thought I'd recap everything that has happened in the company with a "Year In Review" post.